Actual Cumulative Revenue Compared to Budget ($ millions)

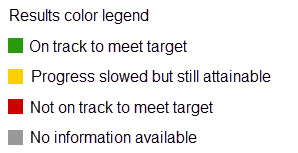

Analysis of Performance

Governmental

Sales and Use Tax is $2.4 million or 4.8% over budget, driven by significantly higher use tax receipts (building permits and audit revenues). Property tax receipts are up $1.5 million over budget, with both February and March exceeding budget amounts. 67.5% of property tax is a pass-thru to PFA under the IGA. Overage on PILOT revenues (primarily from L&P) is a timing issue related to an accounting adjustment that will be cleared in April. Capital expansion fees are up $3.4 million, significantly ahead of budgeted run rates. Monitoring for activity fall-off. Intergovernmental revenues $1.5 million unfavorable variance, primarily $1.3 million timing variance on semi-annual contribution from CSU for transit services (budgeted in March).

Utilities

$4.4 million over budget (primarily $2.8 million from L&P, $0.7 million from Wastewater and $0.5 million in Stormwater). Development fees/PIFs/Contributions accounted for $2.1 million of the positive variance. Interest income contributed $0.7 million over budget.

Monitoring major revenue streams for downturns related to global economic volatility. Specific focus on GF reserve balance impacts.