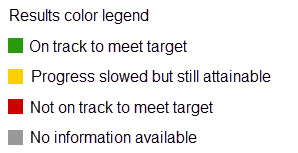

Accuracy of Cumulative Budgeted Expenses ($ millions)

Analysis of Performance

Citywide expenses through Q2 are just below budget, driving the green result YTD. Utilities remain closely managed and are expected to finish the year on target, supporting a positive overall outlook. Government expenditures, however, are running above budget:

On the Governmental side, Personnel Costs are the primary driver, due to much lower-than-expected turnover in the first half of the year. Anticipated savings from position vacancies have not materialized, putting added pressure on the budget.

The City’s expense picture is generally positive, with Utilities staying on track, but higher personnel costs on the government side are creating pressure. As this trend is expected to continue, managerial adjustments are necessary to stay within authorized budget limits.

The City's Governmental Funds (non Utilities) is taking a multi-faceted approach to control expenses:

- In Q2, a soft hiring pause was initiated, allowing vacancies to help offset personnel overages. As of the publication date of the Q2 dashboard, that hiring 'pause' has become a more formal hiring 'freeze' requiring executive approval to fill vacant positions.

- Departments are being asked to tighten discretionary spending and prioritize essential services.

- Ongoing monitoring of personnel costs and turnover trends will guide further adjustments.

These proactive steps aim to slow expense growth, protect essential services, and create flexibility to manage budget pressures through year-end.

Metric Definition

Expenditures are separated into Governmental and Enterprise. Governmental expenditures are for those activities that are primarily supported by taxes and grants and to a much lesser degree from fees. Examples are Police, Streets Maintenance, Parks, Museum, Fire, etc. Alternatively, Enterprise expenditures related to activities that are accounted for like a business and are entirely supported by fees charged to users. These include Light and Power, Water, Wastewater, Storm Drainage and Golf.