Actual Cumulative Revenue Compared to Budget ($ millions)

Desired Result: Above Target

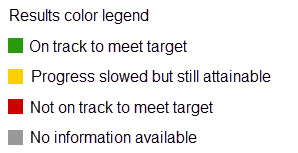

Analysis of Performance

Overall, City revenues are above budget through Q2 2025. Utilities are above budget, show steady growth, and are expected to remain on target for the rest of the year. Governmental Fund revenue, however, are more complex:

- Sales and use tax are above budget through Q2, but much of the increase comes from one-time revenues (e.g., Use Tax spikes, as well as Sales and Use Tax audits)

- These one-time gains have offset a shortfall in recurring, or ongoing, Sales Tax collections during the first two quarters

- Other government revenue sources are tracking close to budget and are being monitored carefully

Revenues are performing well overall, but underlying reliance on one-time revenues signals caution for sustained growth.

Metric Definition

This metric covers differences from anticipated (budgeted) and actual revenue. Revenue includes taxes, fees, grants, fines, interest earnings, etc. Revenue is separated into Governmental and Enterprise depending on the activity it supports. Governmental revenues are typically taxes, grants and fines used to support police, streets, museum, fire and parks. Examples of Enterprise revenue are fees for energy, water, wastewater and golfing.

Why Is This Important?

Accuracy to budgeted revenue is very important to ensure the City can cover its budgeted expenses while maintaining healthy fund balances. The City strives to do a better job being accurate with our revenue forecasts.

City Organization Impact on Performance

High – The City has direct control over its revenue forecasts. Historical analysis of actual revenue compared to budgeted revenue, along with a good understanding of the economic climate should allow the City to improve the accuracy of its revenue forecasts.

Benchmark Information

This metric contains no benchmark data because the target for this metric is not influenced by the performance of other cities. External reference points would add no value to the data because the City's goal is always to be as accurate as possible with its own budgeted revenues.